Kabusshiki Kaisha = KK (type of business entity)

投稿日:

■Outline and establishment

Kabushiki Kaisha (=KK) is the most common and polular corporate form in Japan than other corporate forms. KK is a limited stock corporation, meaning its shareholders are protected from liability claims made by third parties (up to their capital contribution). The minimum capital requirement is JPY 1.

KK must be registered in Japan. KK requires at least one individual as a director and one individual or corporate as a shareholder. They are not required to be JP resident.There is no company secretary system in Japan. Also no need of address certification for company head office.

It typically takes about four weeks to set up KK.

es Act in Japan outlines the requirements for establishing a KK, which has created a number of categories of KK, based on whether it is large or small, open or closed, listed or non-listed. The corporate governance and management structure for KKs will vary depending on whether or not the KK is open or closed, and large or small.

All KKs need at least one director. In cases where three or more directors are appointed, a board of directors and a statutory auditor need to be appointed.

■Corporate Govenance

Shareholder nominate at least one director. The direcotor become Representative of director if KK has one director. If KK has two or more directors, the directors (or shareholder) must assign one Representative of directors. In cases where three or more directors are appointed, a board of directors and a statutory auditor need to be appointed.

Compare to the branch manager of the Branch Office, Representative of director of KK has extremely strong power for company’s business activity. Since the Representaive of director is representing KK, the business contract is made under the name of Representative director. Non-Representative directors can not represent KK in this meaning.

Representative director has strong power for corporate business activity compare to the branch manager of the Branch office. KK is better if you want to delegate Japan business

■Taxation

(General)

KK is subject to corporate tax in Japan. Taxation is as almost same as Branch and GK.

(PE issue)

In principle, KK is not PE (=Permanent Establishment) of shareholder company. If the shareholder company already sales to the customers in Japan, KK is the best form to avoid PE taxation.

関連記事

-

-

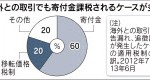

タックスヘイブン対策税制(新聞報道を解説)

昨年末ですが、サンリオが、タックスヘイブン対策税制により、追徴課税を受けました。 …

-

-

テレワーク始まります

ようやくですが、全員にノートパソコンの貸与が終わりました。アルテスタでは社員全員 …

-

-

報酬か給与か?注目の国税不服審判所裁決

国税不服審判所が、平成24年11月1日に、飲食業を営む法人が、そこに所属するホス …

-

-

広大地

三大都市圏であれば面積500㎡以上、それ以外の場所でも面積1000㎡の土地につい …

-

-

相続税 税務調査を受ける確率は?(水曜勉強会)

今日の講師は寺田さん。消費税のインボイス制度や、所得拡大促進税制等、重要なトピッ …

-

-

MJS税経システム研究所 タイ視察セミナー

今日の午前、MJS(ミロク情報サービス)の税経システム研究所のタイ視察セミナーに …

-

-

海外赴任が決まったら

色々やることがあります。 会社側 *出国時年調を行います。出国時までの給与を計算 …

-

-

海外子会社を持つ日本企業 税務調査で何が指摘されているのか? (新聞報道を解説)

海外子会社を有する中小企業への税務調査では、海外子会社が負担すべき経費を日本親会 …