Japan Branch Office(type of business entity)

投稿日:

■Outline and establishment

Branch is generally able to perform sales activities in Japan.

Branch must be registered in Japan and can open corporate bank account under the branch’s name. A branch manager (representative of the JP branch) must be appointed in order for the registration. The branch manager must be JP resident (no nationality requirement).

It typically takes about four weeks to set up a Japan branch.

■Corporate governance

The branch manager is just manager… The foreign headquarter(=HQ) make judgement of the business policy for the JP branch

■Taxation

(General)

A branch is subject to corporate tax in Japan. Taxation is as almost same as coporate type entity such as KK and GK. It is noted that financial statement of HQ must be submitted to tax office when JP branch file its branch financial statement.

(Per capita tax)

Per capita tax is imposed even if the branch do not have income. The amount due it 70,000 yen if the amount of HQ’s paid in capital is less than 10 mil yen. But the per capita tax is increased to 290,000 yen and 950,000yen per year if HQ’s paid in capital is “100 mil to 1 bil yen” and “1 bil to 5 bil yen”.

Branch is not good if HQ’s paid in capital is bigger.

(PE issue)

Branch is a PE (=Permanent Establishment) of HQ. If the HQ sales to the customers in Japan, such sales can be taxed in Japan as the sales is attributed to the JP branch.

It is case by case. But in general, setting up branch is not good if HQ have a sales to JP customer since the HQ is regarded to set up PE in Japan.

(Deemed sales )

The JP branch must recognize sales to HQ if the JP branch support HQ activity (even if the branch do not have sales in Japan). Under JP tax purpose, JP branch is considered as an independent entity from HQ. The idea is, if the branch was independed company from HQ, the company had issued invoices to the HQ. The JP branch is taxed as independed corporate entity from HQ.

関連記事

-

-

新型コロナ感染対策 経済的自粛の影響

警察庁によると、2020年8月、全国で自殺した人は合わせて1849人で、去年の同 …

-

-

米国パートナーシップ最高裁判決(水曜勉強会)

今日の講師は山本さん。各高裁で異なる判決が出されていた、デラウェア州のLimit …

-

-

INAA会議

今回のINAAの世界会議は、上海で行われました。 上海は、10年前に来たことがあ …

-

-

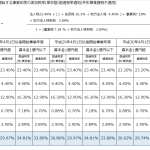

実効税率 平成29年3月決算期用

平成29年3月期の決算で税効果会計を適用する場合の実効税率は下記となります。

-

-

オープンイノベーション税制(水曜勉強会)

今日の勉強会の講師は中川さん。2019年12月12日に決定した与党税制改正大綱の …

-

-

Board Meeting INAA @モントリオール

モントリオールでINAAのBoard Meeting が行われてます。アルテスタ …

-

-

新型ウイルス- 売上が急減した中小企業へのセーフティーネット融資実施へ

新型コロナウイルスの感染拡大で中小企業の経営に影響が出ていることから、政府は、売 …

-

-

コンサル会社3200万円脱税容疑 (新聞報道を解説)

架空広告費は、その広告費がどの口座に支払われ、それがどこで引き出されたのか、、税 …